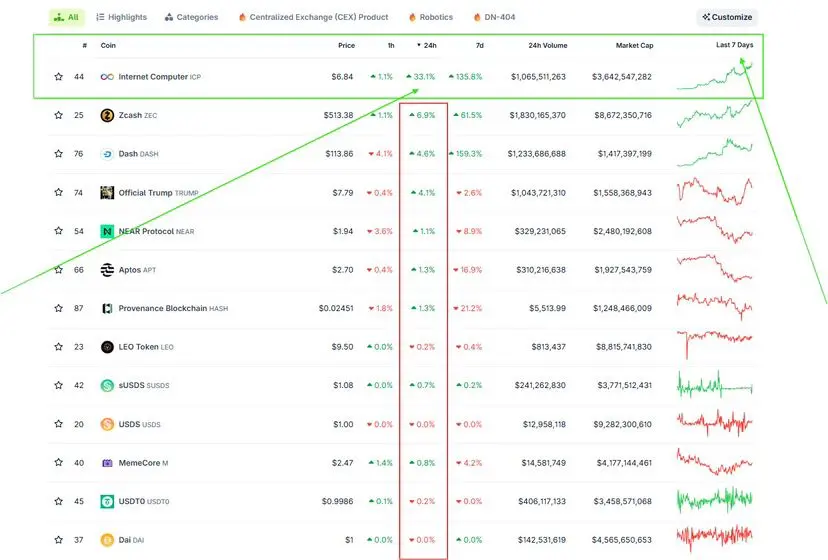

shorting ICP

Conclusion

• Probability of weakening in the next 24 hours: ≈60% (medium to high); however, a common path is to first surge/fake breakout and then pull back, it is not recommended to blindly short near 9.3.

Key Price Level

• Resistance: 9.50–9.70 (intense selling pressure) | 9.80–10.05 (24h high point & integer level, prone to long upper shadow) | 10.35–10.45 (extreme sweep unit)

• Support (retracement from 7.55 to 9.81): 8.95 (38.2%) | 8.68 (50%) | 8.41 (61.8%)

Two shorting strategies (choose one to execute)

A|Shorting at highs (right side is more convenient, but wait for the "rejection signal")

• Observation: In the 5-15 minute timeframe, a long upper shadow appears at 9.50-9.70 or 9.80-10.05 with no follow-through in volume on the rise/fake breakout pullback.

• Entry:

• ① 9.55–9.65 shorting 50%

• ② If there is a false breakout when it breaks 9.90–10.05, then short 30%

• ③ Extreme drop to 10.35±0.1 and then immediately rebound, followed by an additional 20%.

• Stop loss: one cut above 10.45 (do not add positions and hold firm).

• Take Profit: Reduce to break even at 9.30 → Significantly reduce at 9.05–8.95 → Gradually take profits at 8.68 / 8.41.

B|Shorting after the break confirmation (more stable on the left side)

• Trigger: Effectively breaks below 9.05–9.10 and does not retrace above 9.10.

• Entry: 8.95–9.02 shorting in batches.

• Stop-loss: above 9.22.

• Take profit: 8.68 → 8.41, leave a trailing position to watch around 8.10.

Margin Call / Stop Loss Details

• Only add positions at the planned higher resistance level when a clear weakening pattern appears (long upper shadow/fake breakout/volume decline).

• It is strictly prohibited to increase positions while in a losing situation.

• Passive breakout: A scheme breaks above 10.45, B scheme breaks above 9.22——immediate stop loss, wait for the next formation.

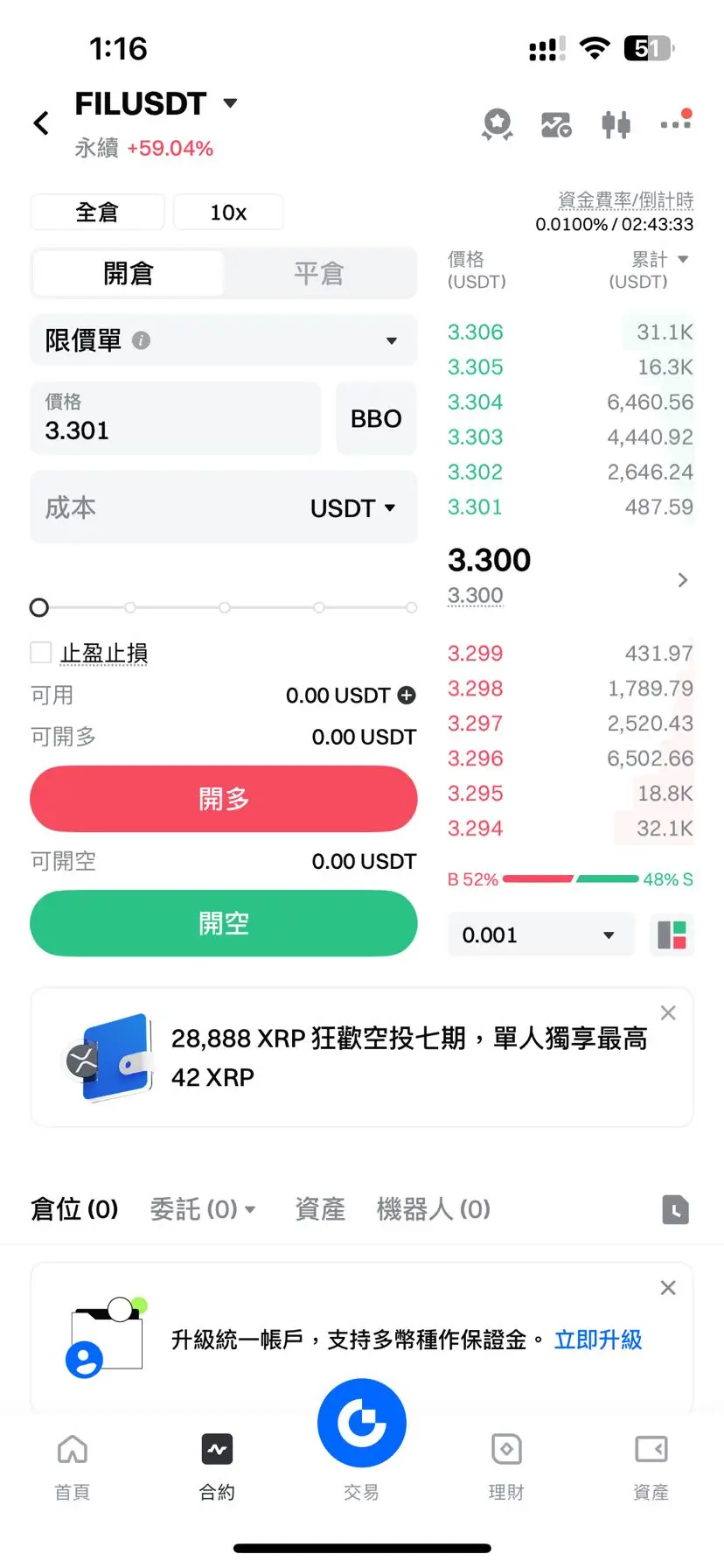

Position and Leverage

• Recommended leverage ≤10x, with a single transaction risk control of 0.5–1% of total funds.

• Reduce positions at each target level in a timely manner and move the stop loss to breakeven to prevent profit retracement.

Operation

• First, look at BTC and the market: if BTC continues to rise, prioritize preventing "another spike."

• Signal Priority: Rejection above > Break confirmation > Median shorting (try to avoid).

• First strong support at 8.95. If it breaks through in one go and fails to pull back, the shorts will have an easier time.🔥🔥#加密市場回調 #İCP #$BTC $ICP

Conclusion

• Probability of weakening in the next 24 hours: ≈60% (medium to high); however, a common path is to first surge/fake breakout and then pull back, it is not recommended to blindly short near 9.3.

Key Price Level

• Resistance: 9.50–9.70 (intense selling pressure) | 9.80–10.05 (24h high point & integer level, prone to long upper shadow) | 10.35–10.45 (extreme sweep unit)

• Support (retracement from 7.55 to 9.81): 8.95 (38.2%) | 8.68 (50%) | 8.41 (61.8%)

Two shorting strategies (choose one to execute)

A|Shorting at highs (right side is more convenient, but wait for the "rejection signal")

• Observation: In the 5-15 minute timeframe, a long upper shadow appears at 9.50-9.70 or 9.80-10.05 with no follow-through in volume on the rise/fake breakout pullback.

• Entry:

• ① 9.55–9.65 shorting 50%

• ② If there is a false breakout when it breaks 9.90–10.05, then short 30%

• ③ Extreme drop to 10.35±0.1 and then immediately rebound, followed by an additional 20%.

• Stop loss: one cut above 10.45 (do not add positions and hold firm).

• Take Profit: Reduce to break even at 9.30 → Significantly reduce at 9.05–8.95 → Gradually take profits at 8.68 / 8.41.

B|Shorting after the break confirmation (more stable on the left side)

• Trigger: Effectively breaks below 9.05–9.10 and does not retrace above 9.10.

• Entry: 8.95–9.02 shorting in batches.

• Stop-loss: above 9.22.

• Take profit: 8.68 → 8.41, leave a trailing position to watch around 8.10.

Margin Call / Stop Loss Details

• Only add positions at the planned higher resistance level when a clear weakening pattern appears (long upper shadow/fake breakout/volume decline).

• It is strictly prohibited to increase positions while in a losing situation.

• Passive breakout: A scheme breaks above 10.45, B scheme breaks above 9.22——immediate stop loss, wait for the next formation.

Position and Leverage

• Recommended leverage ≤10x, with a single transaction risk control of 0.5–1% of total funds.

• Reduce positions at each target level in a timely manner and move the stop loss to breakeven to prevent profit retracement.

Operation

• First, look at BTC and the market: if BTC continues to rise, prioritize preventing "another spike."

• Signal Priority: Rejection above > Break confirmation > Median shorting (try to avoid).

• First strong support at 8.95. If it breaks through in one go and fails to pull back, the shorts will have an easier time.🔥🔥#加密市場回調 #İCP #$BTC $ICP