Hasil pencarian untuk "WELL"

Bitcoin Well Mengonfirmasi $100M Penempatan Pribadi, Tranche Pertama Mengumpulkan CAD 1.249M dan 37.31 BTC

Bitcoin Well sedang melakukan penempatan pribadi sebesar $100 juta, bertujuan untuk meningkatkan cadangan dari 11 BTC menjadi lebih dari 75 BTC. Dana tersebut akan memperluas jaringan ATM BTC dan menstabilkan keuangan. Perusahaan menghadapi tantangan dengan daya saing pasar dan volatilitas harga BTC.

BTC1,1%

Coinfomania·2025-09-30 12:43

Apakah Ethereum Akan Mencapai Prestasi Seperti Bitcoin Pada Tahun 2017?

Tom Lee, co-founder of Fundstrat and a well-known market expert, stated that Ethereum could soon experience a strong bullish phase, similar to what BTC went through in 2017.

Pada saat itu, harga Bitcoin telah meningkat lebih dari 100 kali karena banyak orang mulai menganggapnya sebagai "emas digital". Lee berpendapat bahwa waktu

Blotienso·2025-08-11 16:32

Bitcoin Well membuka pintu ke Lightning Network dan mengubah utang menjadi saham

Bitcoin Well, sebuah perusahaan Kanada utama di sektor bitcoin non-kustodian, mengumumkan integrasi Lightning Network ke dalam portal AS-nya, menjadikan transaksi lebih gesit dan kurang mahal. Di sisi lain, perusahaan ini meluncurkan operasi penyelesaian utang melalui penerbitan saham biasa, sehingga co

TheCryptonomist·2025-04-10 16:00

Wu mengatakan kepada InvestHK: Hong Kong secara alami memiliki keunggulan dalam pengembangan Web3 dan Cryptocurrency

Hong Kong selalu mendukung domain Web3.

Wawancara dengan Mr. Leung Han Jing, Presiden Global Layanan Keuangan dan Teknologi serta Pembangunan Berkelanjutan, Kantor Promosi Investasi Hong Kong

Menulis: Wu tentang blockchain

Mr. Liang Hanjing leads the Financial Services and Technology, Sustainable Development team of the Hong Kong Special Administrative Region Investment Promotion Bureau, attracting international and mainland financial services and technology, sustainable development companies to come to Hong Kong to help enrich the financial ecosystem. Prior to joining the government, Mr. Liang Hanjing served as a technology company founder, angel investor, and financial technology lecturer. Mr. Liang Hanjing's first data-related startup was established through early investment from Credit Suisse, a Swiss banking group. His company directly serves many well-known financial institutions, including wealth management, insurance, consumer finance, etc. Mr. Liang Hanjing also worked at the US Booz Allen & Hami

ForesightNews·2025-03-13 13:19

Pada kuartal keempat, Holding ETF Ethereum Goldman Sachs melonjak 2.000% menjadi $4,76 miliar

Goldman Sachs' ETH Square ETF holdings in the fourth quarter of 2024 surged 2000% from $22 million to $476 million, mainly allocated to BlackRock iShares ETH Square Trust Fund and Fidelity ETH Square Fund, as well as an investment of $6.3 million in Grayscale ETH Square Trust Fund. Previously, the total value of the bank's BTC Spot ETF had exceeded $1.5 billion.

DeepFlowTech·2025-02-12 11:24

Story: Satu-satunya blockchain Layer 1 yang diinvestasikan secara berturut-turut oleh a16z, sedang menembus hambatan terbesar AI

Story is a Layer 1 blockchain startup that focuses on intellectual property protection. It utilizes blockchain technology to transform intellectual property (IP) into programmable digital assets for the protection, sharing, and monetization of IP. This provides a new solution for IP holders to participate in AI-driven innovation and decentralized collaboration in a safer manner. Recently, Story has partnered with the well-known AI company Stability AI to become the first blockchain project that combines mainstream language models, aiming to create a more secure AI development environment.

CoinVoice·2025-01-24 11:40

Polisi Niagara Memperingatkan tentang Penipuan ATM Kripto: Meluncurkan Kampanye Kesadaran Publik

Kemitraan untuk Bekal Melawan Penipuan

Polisi Regional Niagara di Ontario telah bekerja sama dengan operator ATM cryptocurrency terkemuka untuk meningkatkan kesadaran masyarakat tentang risiko penipuan. Perusahaan seperti Bitcoin Depot, Bitcoin Well, Bitcoin4U, HODL, Instacoin, dan LocalCoin menjadi bagian dari inisiatif tersebut.

Moon5labs·2025-01-23 00:00

V God supports Soneium's "Meme Koin Blacklist" well: it demonstrates openness for enterprises to adopt L2

Proyek Layer2 Soneium yang diluncurkan oleh grup Sony Corporation Jepang pada hari pertama Mainnet mengakibatkan ketidakpuasan yang kuat di kalangan komunitas pengguna karena sebagian Token dimasukkan ke dalam daftar hitam. Terkait tindakan daftar hitam Soneium, pendiri Ether Vitalik Buterin justru memberikan pujian, menyatakan bahwa tindakan daftar hitam Token merupakan contoh bagus bagi perusahaan yang mengoperasikan Layer2, di mana perusahaan dapat bebas memilih seberapa besar kontrol on-chain yang ingin dipertahankan. (Latar belakang: Analisis Proses Web3 SONY selama Delapan Tahun: Mengapa Potensi L2 "Soneium" Mungkin Terlalu Dinilai?)(Latar belakang: Vitalik Marah pada dunia kripto saat ini: Mata Uang Kripto Telah Melenceng Jauh dari Kriptografi dan Keamanan Informasi, Ini Kegagalan Besar) Raksasa elektronik Jepang, Grup Sony (Sony Group), sebelumnya bekerjasama dengan pengembang infrastruktur dasar Web3 Starale

ETH0,61%

動區BlockTempo·2025-01-16 11:03

Koin Presale ini Mungkin Menjadi GEM Tersembunyi yang Akan Mengungguli Chainlink Hingga 2025

Pasar kripto adalah sebuah realm of unpredictability, with hidden gems often surpassing expectations and overtaking well-established names.

Sementara Chainlink tetap menjadi kekuatan besar dalam ruang blockchain oracle, koin presale baru, Lightchain AI, mendapatkan perhatian karena potensinya untuk melampaui pasar kripto utama.

LINK0,51%

CryptoDaily·2025-01-10 00:33

Seorang Hakim Federal Baru Saja Menghentikan SEC. Inilah Artinya. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

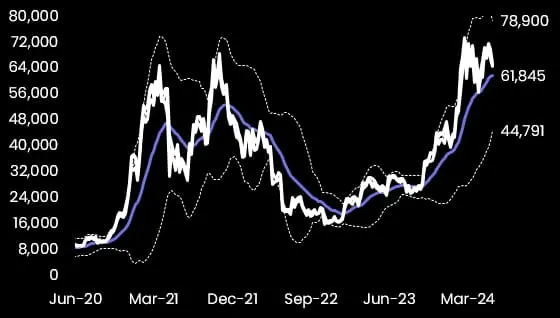

Delphi Digital Outlook 2025: Jika sejarah terulang, BTC akan melampaui $175.000

Penulis asli: Delphi Digital

编译|Odaily星球日报(@OdailyChina)

Penerjemah | Azuma (@azuma_eth)

Editor's Note: On December 11th, Delphi Digital, a well-known investment research institution, released a market outlook report for the cryptocurrency industry in 2025. This article is the first part of the report, which mainly outlines Delphi Digital's analysis of the trend and upward potential of Bitcoin in 2015.

Delphi Digital menyatakan bahwa jika tren sejarah terulang, Bitcoin akan naik sekitar $175.000 dalam siklus ini, bahkan mungkin naik hingga $190.000 - $200.000 dalam jangka pendek.

Berikut adalah Delphi Digital

星球日报·2024-12-12 09:22

CEO Ripple Merespons Pengajuan ETF Baru Saat Harga XRP Melewati Level Kunci

CEO Ripple excited by Bitwise ETF filing including XRP, as well as BTC, ETH, and SOL.

UToday·2024-11-15 14:24

Acara Man-Quan: Penambangan Bitcoin di Amerika Utara, Bagaimana Lebih Ramah Lingkungan?

Mr. Lei Jun from the perspective of industry practitioners, deeply discusses the current situation and future of encrypted assets mining overseas, and provides a lot of valuable first-hand information and insights. He shares the background of the birth of Bitcoin and the concept of decentralization, as well as the glory and policy transformation of mining in China. Finally, Mr. Lei Jun also talks about the combination of Bitcoin mining and green energy and the future development prospects. At the same time, Man Kun Law Firm also provides professional support and solutions.

BTC1,1%

MancunBlockchainLegal·2024-11-15 09:59

Altcoin ini terbang pada bulan Oktober: Apakah banteng akan terus berlanjut?

Pada bulan Oktober, terjadi kenaikan yang signifikan di pasar kripto. Altcoin Virtuals Protocol (VIRTUAL), SPX6900 (SPX), Moonwell (WELL), Raydium (RAY), dan Cat in a dog's world (MEW) menjadi salah satu yang paling berkembang. VIRTUAL, yang mengintegrasikan kecerdasan buatan ke dalam lingkungan virtual, naik 566 persen pada bulan Oktober. SPX diluncurkan dengan pendekatan memecoin dan mengalami kenaikan sebesar 346,5 persen pada bulan Oktober. Moonwell meningkat 165,1 persen sebagai proyek keuangan terdesentralisasi. Raydium, sebagai salah satu proyek yang fokus pada keuangan terdesentralisasi dan ekosistem kripto, naik sebesar 79 persen. Satu-satunya memecoin yang masuk dalam daftar, Cat in a dog's world, mencatat kenaikan 69,4 persen pada bulan Oktober dan menarik perhatian.

Coinkolik·2024-10-31 23:15

Harga koin melonjak, TVL kembali, pemimpin lama utama Aave pertama kali pulih

Penulis Asli | Green Light Capital

Penerjemahan | Odaily Planet Daily (@OdailyChina)

Penerjemah | Azuma(@azuma\_eth)

Editor's note: Lending utama Aave (AAVE) has shown a reverse trend independent of the weak performance of the zona in the past few months, while the prices of tokens of various well-established decentralized financial protocols have been stagnant. AAVE's price has quietly doubled, from around $80 on August 5th to over $170 now.

Dengan resmi memasuki siklus pemangkasan suku bunga oleh Federal Reserve, diskusi tentang kembalinya "musim altcoin", terutama suara-suara tentang kebangkitan Keuangan Desentralisasi, semakin meningkat, dan Aave tampaknya telah menjadi yang pertama pulih. Dalam artikel berikutnya, Green Light

星球日报·2024-09-25 06:12

Penjualan lebih dari 2 miliar dolar Bitcoin, apakah pemilik individu harus mengikuti atau bertahan?

Penulis: 10x Research

Kompilasi: Wenser, Harian Bintang Odaily

Editor's note: The well-known investment research institution 10X Research has once again expressed its latest views on the Bitcoin market. Combining recent Bitcoin ETFs, miners, listed mining companies, and early Bitcoin holders' sales, 10X Research has given a price prediction for the next stage of the market. Whether it can reach the expected level may determine the future direction of the market. Odaily Planet Daily will compile this article for reference.

Model siklus empat tahun dan pasokan-peredaran adalah alat penting untuk memprediksi harga.

Sebagai dasar perkiraan harga Bitcoin, pola siklus parabolis yang memprediksi setiap empat tahun sangat penting, ini juga 95%

链捕手·2024-06-21 06:33

Arthur Hayes: Penjualan obligasi AS oleh bank Jepang mendorong pasar bullish baru untuk mata uang kripto

Judul Asli: Shikata Ga Nai

Penulis asli: Arthur Hayes

Terjemahan artikel asli: Ismay, BlockBeats

Editor's Note: Against the backdrop of global economic turmoil and market volatility, Hayes delves into the challenges faced by the Japanese banking system in the Federal Reserve's rate hike cycle, as well as the far-reaching impact of US fiscal and monetary policies on the global market. By analyzing in detail the forex hedging strategies of the Japan Agricultural Cooperatives Central Bank and other Japanese commercial banks in relation to US Treasury investments, the article reveals the reasons why these banks have to sell US Treasury bonds when interest rate differentials widen and forex hedging costs rise. Hayes further discusses FIMA

NAI0,41%

星球日报·2024-06-21 02:48

10x Research: Pesimis tentang prospek ETH, diperkirakan BTC akan mencapai tinggi baru - ChainCatcher

Penulis: Markus Thielen, Penelitian 10x

Kompilasi: Azuma, Odaily Planet Daily

Editor's note: This article is a compilation of two market analysis articles published by well-known investment and research institution 10x Research last night and this morning. In the first article, 10x Research mainly analyzed the pessimistic reasons for the future market of ETH; in the second article, 10x Research predicted that BTC's new high is coming soon.

Berikut adalah cuplikan inti dari dua artikel 10x Research.

Tentang ETH: Mengapa Kami Tegas Bearish?

Dalam sebulan terakhir, kapitalisasi pasar Ethereum naik 22%, mencapai 454 miliar dolar, sementara pendapatan biaya Ethereum turun 33%, hanya 1,28

链捕手·2024-06-05 07:25

Muat Lebih Banyak